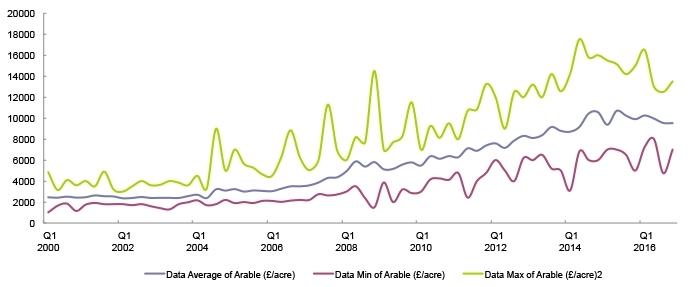

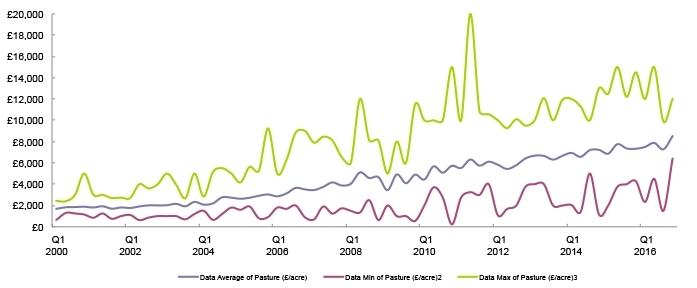

English farmland values have become more polarised than in living memory, with the highest prices paid for land more than double the lowest, according to agency Strutt & Parker.

Michael Fiddes, Head of Estates & Farm Agency for Strutt & Parker, said analysis of the firm’s Farmland Database showed average arable land values at the end of 2016 were £9,500/acre - 4% lower than they were the previous year.

“However, the average price only tells part of the story as it masks a huge range in the prices achieved.

“The market is now more polarised than in living memory, with demand extremely location specific. An example from the south west of England highlights the extent to which this is the case. While one 150-acre block of Grade 3 arable land recently achieved just under £8000/acre, another very similar block four miles away sold for £15,000/acre.

“There is still strength in the market - just under half of arable land sold in England in 2016 was sold for £10,000/acre or more, which is one of the largest proportions ever. But demand, like prices, is highly variable and almost 40% of the land marketed in 2016 remains available.”

Mr Fiddes said the Brexit vote may have been the defining moment of 2016 politically, but its immediate impact on the land market had been more muted than some anticipated.

While a number of sales were renegotiated in the weeks following the vote, very few deals fell through.

“Brexit’s biggest impact was to cause uncertainty, which did result in a slowdown in the amount of land coming forward over the first nine months of the year. However, there was resurgence in the last quarter, meaning that while supply was down on 2015 levels it is in line with the five-year average.

“Some buyers and sellers are being more cautious as the long term level of support for agriculture remains uncertain.

“However, the big story in the farmland market has continued to be the impact of the squeeze on farm profits as a result of low commodity prices. With around half of all farmland transactions being ‘farmer-led’, it is not surprising that as farm incomes have dropped so have average land prices.”

Mr Fiddes said higher prices are typically being achieved if there is a good house as part of the package that appeals to residential buyers or if a neighbouring landowner is particularly focused on expansion and is prepared to pay a premium to secure land that adjoins their existing holding.

“In addition, there are a number of institutional buyers willing to invest in blocks of land which have long-term potential for residential development.

“Looking forward, location rather than quality will continue to be the key factor in determining farmland values. The level of supply in 2017 will also be a critical factor.

“Getting the right advice on local market conditions has never been more critical - for buyers and sellers. Knowledge is power.”

Charlie Evans, head of Strutt & Parker’s estate and farm agency team in the south west region, said: “One of the biggest changes we have seen over the past year is that there are now usually only one or two buyers for a farm, rather than several.

“Properties that are best in their class still attract a great deal of interest from further afield, but in most instances the eventual buyers are neighbours looking to increase their acreage.

“There is always a buyer, but the price has to reflect the quality of the ground and the demand. We are seeing arable prices in the region ranging from £8,000/acre to £15,000/acre.

“If there is competition prices will often exceed guides, but more farms are being sold at or at less than guide than in previous years.

“We’ve also seen a big increase in the number of people wanting to privately market their farms, often asking for a premium. Those which haven’t sold are likely to come to the open market in spring 2017, but will need a price adjustment to sell.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here